Market Cycles and Long-Term Wealth Building

This article explores how dividends behave through economic cycles and how dividend investors can manage income production across their investment lifetime.

"Markets breathe in cycles. Dividend investors should learn to inhale and exhale calmly, not gasp." --- Howard Marks

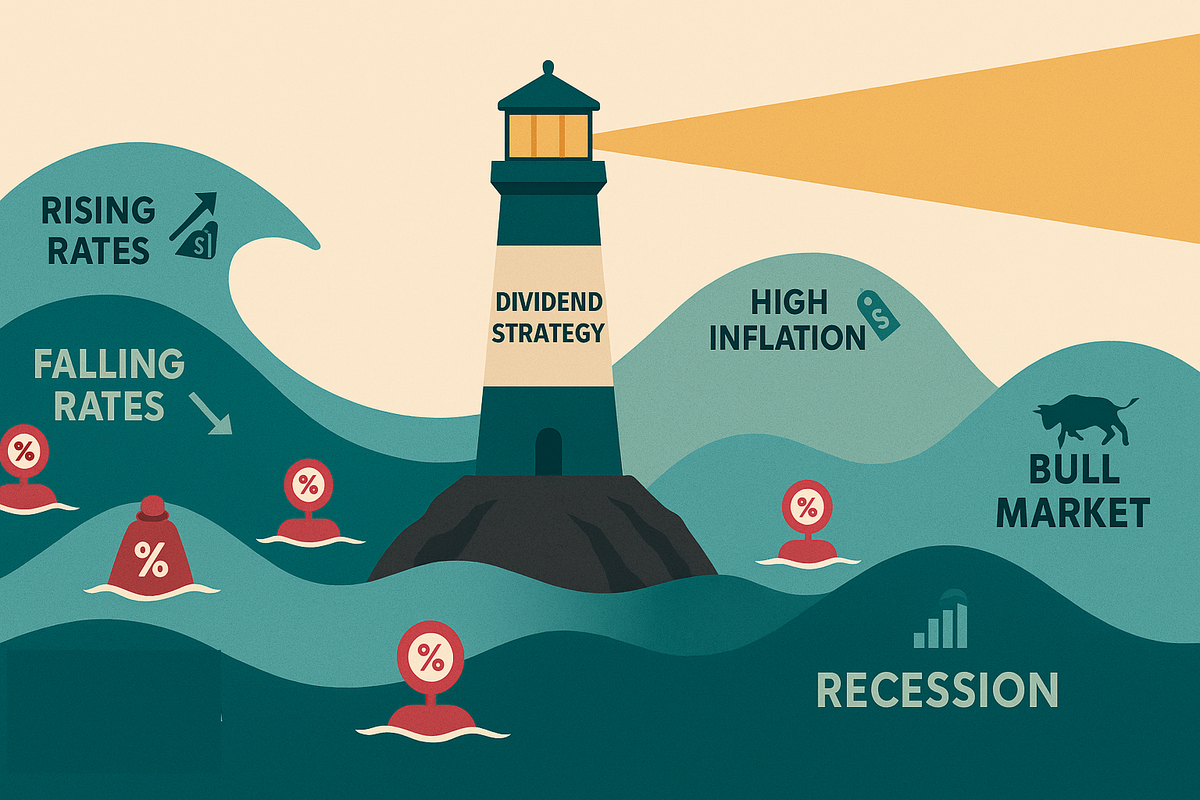

Dividend yields don't exist in isolation. They interact with economic cycles, such as interest rates, inflation, recessions, or bull markets, in predictable and sometimes surprising ways. Understanding these relationships helps you navigate market turbulence, make strategic decisions across cycles, and build long-term wealth confidently.

This article explores how dividends behave through economic cycles and, critically, how dividend investors can manage income production across their investment lifetime.

Interest Rates and Dividend Stocks: The Inverse Relationship

When the Federal Reserve changes interest rates, dividend stock valuations often move inversely. This relationship is fundamental.

Rising Interest Rates: Headwinds for Dividend Stocks

When rates rise (the Fed tightens monetary policy), several dynamics pressure dividend stocks:

- Competition from Fixed Income: Higher Treasury yields make bonds more attractive. A 10-year Treasury yielding 4.5% competes directly with a dividend stock yielding 3%. Investors shift capital to bonds.

- Higher Discount Rates: Dividend stocks are valued by discounting future dividends. Higher interest rates increase the discount rate, reducing present value. A dividend expected to grow 5% annually is less valuable when discounted at 6% than at 4%.

- Slower Earnings Growth: Rising rates slow economic growth. Companies may see earnings pressure, forcing dividend cuts or freezes.

Historical example: In 2022, the Fed raised rates from near 0% to over 4% in less than a year. Dividend stocks (particularly REITs and utilities, which are rate-sensitive) fell sharply. The S&P 500 fell 18%, but REITs fell nearly 30%.

Falling Interest Rates: Tailwinds for Dividend Stocks

When rates fall (Fed eases), dividend stocks often rally:

- Bonds Less Attractive: Lower Treasury yields make dividend yields relatively more attractive. A 3% dividend yield looks good when Treasuries yield 1%.

- Higher Valuations: Lower discount rates increase present value of future dividends. Dividend stocks become worth more.

- Economic Growth: Falling rates typically occur when the economy is slowing or in recession. Once the economy recovers, earnings grow and dividends rise.

Another historical example: In 2020, after the COVID-19 crash, the Fed cut rates to near 0%. Dividend stocks (particularly REITs and utilities) recovered sharply. The S&P 500 gained 28% in 2020; dividend-focused sectors gained more.

The Strategic Implication

Rising rate environments are challenging for dividend investors. If you're near or in retirement and need income, rising rates reduce your portfolio's purchasing power. Conversely, falling rate environments are bullish for dividend stocks.

This doesn't mean you should time the market (virtually impossible). Rather, it means:

- Expect volatility: Interest rate cycles create dividend stock volatility. Stay calm.

- Reinvest during downturns: When dividend stocks fall due to rising rates, continuing to reinvest dividends buys more shares at lower prices. This is a feature, not a bug.

- Balance with bonds: Holding some bonds provides ballast during rising-rate periods and income to reinvest when rates stabilize.

Inflation and Dividend Growth: A Natural Hedge

Over long periods, dividend-growth stocks have historically outpaced inflation. This makes them a natural inflation hedge.

How Dividend Growth Outpaces Inflation

Companies with pricing power (strong brands, durable advantages) can raise prices in line with inflation and often faster. When inflation rises, these companies raise dividends to offset it.

Real example: Coca-Cola has raised its dividend annually for 60+ years, growing dividends faster than inflation on average. An investor receiving $1,000 annually in dividends from Coca-Cola in 2000 now receives over $3,000 annually, well ahead of inflation.

Which companies have pricing power?

- Consumer brands: Coca-Cola, Procter & Gamble, McDonald's (customers tolerate price increases).

- Tech with network effects: Microsoft, Apple (competitive moats justify price increases).

- Healthcare: Healthcare companies often raise prices faster than general inflation.

- Utilities: Regulated utilities typically adjust rates annually for inflation.

Which companies lack pricing power?

- Commodity producers: Oil, metals, agriculture (prices set by global supply/demand).

- Retail: Competitive pressure limits price increases.

The Strategic Implication

If you're concerned about inflation eroding purchasing power, focus dividend investments on dividend-growth stocks with pricing power. Avoid commodity exposure. Over 20–30 years, dividend growth from quality companies significantly outpaces inflation.

Recessions and Dividend Cuts: Separating Quality from Risk

Recessions test dividend sustainability. During economic downturns, weak companies cut dividends to preserve cash. Strong companies maintain or raise them.

What Happens to Dividends in Recessions?

During the 2008 financial crisis:

- Strong companies (e.g., Johnson & Johnson, Procter & Gamble): Maintained or slightly raised dividends.

- Weak companies (e.g., financial stocks, automakers): Cut dividends 50–100%.

The experience teaches an important lesson: dividend quality matters most during recessions.

Why do some companies cut and others don't?

Strong-balance-sheet companies:

- Have cash reserves to weather revenue declines.

- Generate strong free cash flow even during downturns.

- Have diverse customer bases and products (reduce industry risk).

- Can access credit markets during crises.

Weak-balance-sheet companies:

- Operate with thin margins and little cash.

- Depend on continued capital access (unavailable during crises).

- Have leverage that becomes burdensome.

- Operate in cyclical industries hit hard by recessions.

Historical Dividend Aristocrats Through the 2008 Crisis:

Dividend Aristocrats (25+ years of consecutive increases) showed remarkable resilience in 2008. Most maintained dividends; many raised them. This demonstrates that dividend quality (history + balance sheet strength) predicts recession-resilience.

The Strategic Implication

During economic uncertainty or downturns:

- Don't panic-sell dividend stocks: The best time to own dividend stocks is often during recessions, when yields spike due to price declines but fundamentals remain strong.

- Focus on quality: Stick with Dividend Aristocrats, Dividend Kings, and companies with fortress balance sheets. Avoid highly leveraged vehicles (BDCs, REITs with weak coverage).

- Accumulate during downturns: If you're still working or have cash, market downturns are when you should be most active, buying quality dividend stocks at depressed prices.

- Test your positions: After a recession hits, reexamine your portfolio. Which holdings are cutting dividends? Which are raising? Let results inform future allocation.

Bull Markets and Dividend Underperformance: Staying the Course

Paradoxically, dividend stocks often underperform during strong bull markets. This can test your commitment.

Why Dividend Stocks Lag in Bull Markets

During bull markets:

- Speculative/growth stocks soar: Investors chase high-growth companies (tech, biotech, unprofitable startups). These companies have no dividends but promise capital appreciation.

- Dividend stocks seem boring: A 3% yielding dividend stock returning 8% annually (3% yield + 5% growth) underperforms a zero-dividend tech stock returning 30%.

- FOMO kicks in: Investors see peers in speculative stocks making more money and feel foolish holding "boring" dividend stocks.

Historical example: 2016–2021 was a tech bull market. Growth stocks returned 25%+ annually; dividend stocks returned 7–10%. An investor who sold dividend stocks to chase tech in 2017 regretted it when tech crashed 50% in 2022, while dividend stocks fell only 15%.

The Strategic Implication for a Dividend Portfolio

During bull markets:

- Don't chase performance: Just because growth stocks are outperforming doesn't mean you should abandon dividend investing.

- Remember your goal: If your goal is long-term wealth and income, dividend investing is a multi-decade strategy. One 5-year period of underperformance is noise.

- Rebalance disciplines: Set an annual rebalance rule. If dividend stocks have fallen below your target allocation due to underperformance, buy more (buying low).

- Psychological fortitude: The hardest part of dividend investing is staying disciplined when others are getting rich quick elsewhere. But history shows disciplined dividend investors outperform over full cycles.

The Wealth Accumulation Phase: Building the Portfolio

For investors in their 30s, 40s, and early 50s, the focus is accumulation: building a portfolio that will eventually produce income.

During the accumulation phase:

- Reinvest all dividends: Don't spend the income; reinvest it to buy more shares. The snowball effect is most powerful over 20–30 years.

- Focus on dividend growth, not yield: A 2% yielding stock with 7% annual dividend growth outpaces a 6% yielding stock with 1% growth. Choose the former.

- Dollar-cost average: Invest a fixed amount regularly (e.g., $500/month). You automatically buy more shares when prices are low, fewer when high.

- Ignore market cycles: Rising rates, falling rates, recessions, bull markets are all noise during a 20-year accumulation. The prime strategy here is to stay invested and keep adding.

Sample accumulation strategy:

Invest $1,000/month in a dividend-growth fund or individual dividend-growth stocks. Reinvest all dividends. Ignore market movements.

Starting at age 35 with $1,000/month:

- After 10 years: ~$140,000 (contributions + growth)

- After 20 years: ~$420,000 (contributions + growth)

- After 30 years: ~$900,000+ (contributions + growth)

The exact number depends on total return (dividend + appreciation), but the magnitude illustrates the power of consistent, long-term investing.

The Transition Phase: From Accumulation to Income

As you approach retirement (age 55–65), you transition from accumulation to income production. This shift is critical.

During the transition phase:

- Begin reducing reinvestment: Instead of reinvesting all dividends, perhaps reinvest 50% and spend 50%. This tests whether your portfolio generates enough income to live on.

- Evaluate portfolio income: Calculate your portfolio's actual yield. For retirement to be sustainable, your portfolio should yield 4–5% if you plan to draw that much annually.

- Shift toward income producers: If your portfolio yielded 2% (growth-focused), you might increase allocation to 4–5% yielders (REITs, BDCs, utilities) to boost income production.

- Diversify by stage: Hold a mix of early-dividend growers, mid-stage dividend producers, and mature high-yielders to ensure steady income regardless of market environment.

Example transition portfolio (age 55, $500,000 saved):

- 40% ($200K): Dividend-growth stocks, reinvesting 50% of dividends.

- 30% ($150K): REITs and utilities, spending dividends.

- 20% ($100K): Bonds, spending interest.

- 10% ($50K): Cash, spending strategically.

Expected yield: ~4%, providing $20,000 annually.

The Income Phase: Living Off Dividends

Once retired, the goal is simple: live off dividends and portfolio growth without depleting principal.

During the income phase:

- Spend dividends strategically: Spend from highest-yield holdings first. Reinvest lower-yielding stocks to maintain growth.

- Monitor coverage: Track payout ratios, free cash flow, and dividend growth. If a company's payout ratio rises to 80%+ or FCF coverage falls below 1.2, consider trimming that position.

- Rebalance annually: If dividend-focused holdings have grown to 60% of the portfolio (from 50%), trim and redeploy to growth stocks. Maintain your target allocation.

- Adjust for life events: As you age (70s, 80s+), you may increase income focus and reduce growth exposure. A 75-year-old doesn't need 30-year growth as much as a 60-year-old.

"Safe withdrawal" rules (for illustration; consult an advisor):

The "4% rule" suggests that withdrawing 4% annually from a diversified portfolio (60% stocks, 40% bonds) historically hasn't depleted principal. A $500,000 portfolio supports $20,000 annually.

However, this assumes stock market returns; dividend yields alone might support only 3–3.5%. A portfolio yielding 4% produces $20,000 annually with less reliance on market appreciation.

The Psychology of Transition: From Growth to Income

One of the most overlooked aspects of dividend investing is the psychological transition from accumulation to income. As fixed-income specialist James Hymas notes in his work on investor behavior, many investors struggle emotionally shifting from "watching my portfolio grow 8% annually" to "living off 4% in dividends."

Your total return hasn't changed; you're just receiving it differently.

Consider an investor with a $1,000,000 portfolio that yields 4% and appreciates 3% annually. Total return is 7%. During accumulation, you reinvested that 7% and the portfolio grew $70,000. During income, you're spending the 4% ($40,000) and letting 3% appreciation ($30,000) compound. Your total return is still 7%, but you're taking $40,000 as income instead of reinvesting all $70,000.

Psychologically, this feels like "less return," but it's not. You're simply receiving part of your returns as cash rather than price appreciation. The mathematics haven't changed; the presentation has.

This concept is crucial: If you can internalize that living off 4% of a portfolio that's appreciating 3% is equivalent to reinvesting 7%, you won't panic when you transition from accumulation to income. You're not reducing your returns; you're changing how you deploy them.

Case Study: A 30-Year Journey

To illustrate, here's a hypothetical journey:

Age 35 (Accumulation):

- Portfolio: $50,000 (savings + early 401k/IRA)

- Strategy: Buy dividend-growth stocks, reinvest all dividends.

- Annual contribution: $12,000 (savings)

Age 55 (Transition)

- Portfolio: ~$400,000 (contributions + growth + reinvested dividends)

- Strategy: Shift to 50% reinvestment, 50% spending. Allocate 30% to REITs/BDCs for income.

- Estimated yield: 3% ($12,000 annually)

Age 65 (Income)

- Portfolio: ~$800,000 (contributions + growth + reinvested dividends)

- Strategy: Spend 4% ($32,000 annually) from high-yield holdings. Reinvest lower-yield growth stocks.

- Estimated income: $32,000 annually (supplemented by Social Security)

Age 80 (Late Retirement)

- Portfolio: ~$1,000,000+ (modest growth + spending offset by compounding)

- Strategy: Spend 5% ($50,000 annually), the portfolio has grown despite withdrawals.

- Estimated income: $50,000 annually + Social Security + other sources

The power of this journey is compounding over decades. By staying disciplined through cycles, reinvesting during accumulation, and transitioning strategically to income, you build a portfolio that supports your lifestyle without depletion.

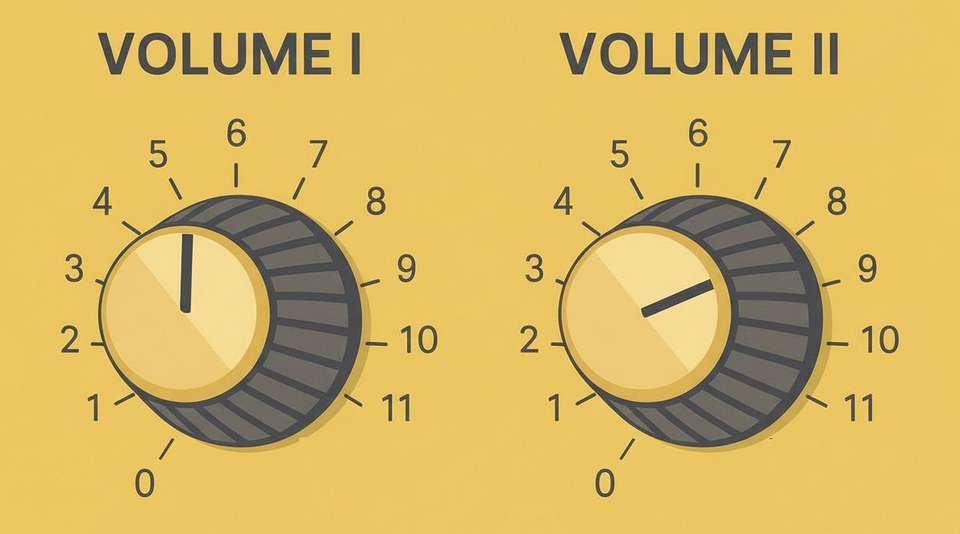

Staying Calm Through Cycles

The hardest part of long-term dividend investing isn't analytical; it's behavioral.

When rates rise and dividend stocks crash, the temptation is to sell and chase bonds. Resist. In two years, rates may fall and dividend stocks will have recovered.

When tech stocks soar and dividend stocks lag, the temptation is to chase performance. Resist. In the next downturn, dividend stocks provide ballast.

When your portfolio hasn't grown in three years, the temptation is to give up. Resist. Multi-decade investing requires patience through weak periods.

Disruptive Events and Market Shocks: Unique macroeconomic events—including the COVID era, periods of ultra-low or negative interest rates, and regulatory changes—have historically disrupted dividend safety and payouts. Many blue-chip firms were forced to suspend or alter dividend policies in 2020, reminding investors that “safe” payouts can be vulnerable to unexpected shocks.

The investors who succeed aren't necessarily the smartest. They're the most disciplined. They stick to their plan through cycles, reinvest during downturns, and stay the course.

Conclusion: Building Wealth Through Cycles

Dividend investing is a multi-decade journey. It encompasses accumulation (reinvest everything), transition (begin spending), and income (live off the portfolio) phases. Market cycles like rising rates, recessions, or bull markets create volatility along the way, but don't derail the long-term trajectory.

The investors who succeed are those who understand these cycles, remain calm during turbulence, and stay disciplined in their process. Over 30–40 years, discipline and compounding build into extraordinary wealth and financial independence.

References

Miller, Lowell. The Single Best Investment: Creating Wealth with Dividend Growth. Adams Media, 2006.

Marks, Howard. Mastering The Market Cycle: Getting the Odds on Your Side

Hymas, James. Security of Income vs. Security of Principal: Long-Term Fixed-Income and Dividend Investing for Retirees. Portfolio construction research and investor behavior analysis available via himivest.com and prefblog.com (self-published research)