Municipal Income Strategies Beyond “Tax-Free Yield”

Municipal bonds are valuable income tools - and full of hidden risks.

Municipal income is often introduced to investors through a single phrase: tax-free yield. While that feature is real and valuable, it is also an incomplete description of how municipal income strategies behave in practice.

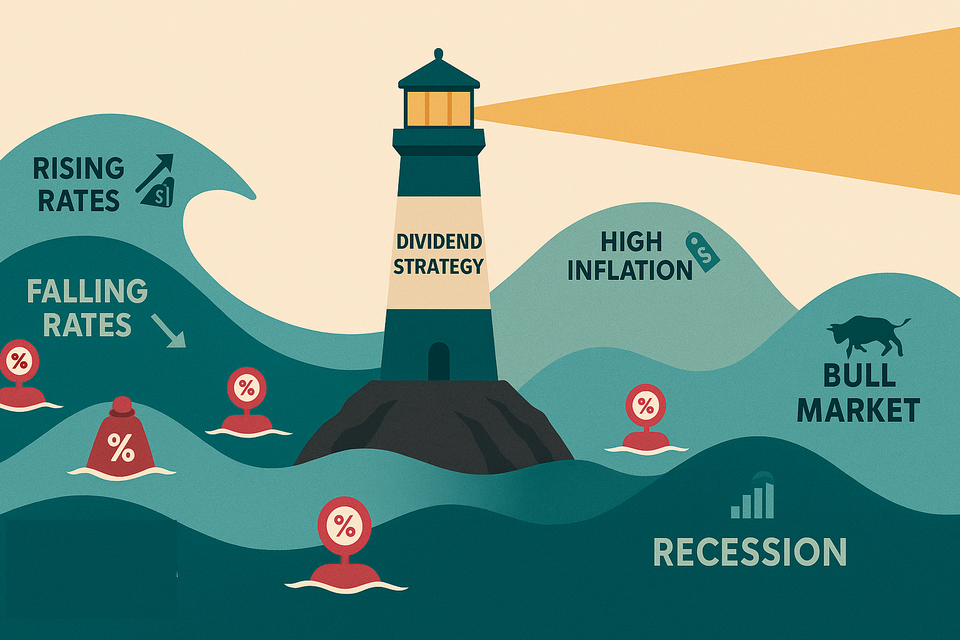

Municipal bonds are not defined by tax treatment alone. They are shaped by credit quality, interest-rate sensitivity, leverage decisions, and market liquidity. Investors who focus narrowly on headline yield or tax equivalence often miss the forces that actually drive outcomes.

Understanding municipal income requires looking past the exemption and into the structure.

What Municipal Bonds Really Are

Municipal bonds are debt obligations issued by states, cities, agencies, and authorities to fund public projects and ongoing operations. Revenues may come from general taxation, specific project cash flows, or dedicated fees.

At a high level, municipal credit quality has historically been strong. Defaults are relatively rare compared with corporate credit. That reputation for safety, however, can create complacency.

Municipal bonds are still bonds. They carry duration risk, credit dispersion, and liquidity constraints that become visible under stress.

The Central Role of Interest Rate Sensitivity

For many municipal strategies, interest rate exposure is the dominant risk driver.

Long-dated municipal bonds are particularly sensitive to changes in rates because their coupons are often lower than those of taxable alternatives. When rates rise, price declines can be meaningful, even if credit quality remains intact.

This dynamic surprises investors who equate “tax-free” with “low risk.” The risk is not default. It is price volatility driven by duration.

How Leverage Enters the Picture

Many municipal income funds, particularly closed-end structures, use leverage to enhance yield. Borrowing at short-term rates and investing in longer-dated municipal bonds increases distributable income in stable environments.

The tradeoff is convexity. When rates rise or yield curves invert, borrowing costs increase while asset values decline. The result can be NAV compression and distribution pressure, even when underlying bonds continue to pay as promised.

This is not a flaw in municipal finance. It is a structural consequence of leveraged fixed-income strategies.

Credit Quality Is Not Uniform

Municipal credit is often discussed as a monolith, but it is highly heterogeneous.

General obligation bonds backed by taxing authority behave differently from revenue bonds tied to toll roads, hospitals, utilities, or transportation hubs. State and local fiscal health, demographic trends, and pension obligations all influence credit outcomes.

Periods of stress tend to reveal these differences quickly. Bonds tied to narrow revenue streams or challenged municipalities may experience spread widening, even if defaults remain rare.

An Illustrative Stress Example

The restructuring of Puerto Rico’s municipal debt earlier in the last decade serves as a useful illustration. For years, high yields masked structural fiscal imbalances. When conditions deteriorated, investors learned that “municipal” does not guarantee uniform credit quality or outcome.

The lesson is not about any single issuer. It is about dispersion. Municipal markets reward selectivity, not assumptions.

Tax Treatment and Reporting Reality

Municipal bond income is generally exempt from federal income tax and, in some cases, from state and local taxes as well. This feature can materially improve after-tax income for certain investors.

From a reporting standpoint, most municipal funds and securities issue a Form 1099, not a K-1. Income is typically classified as tax-exempt interest, though capital gains may still apply.

Tax benefits are real, but they do not eliminate economic risk. Price volatility still affects total return and portfolio flexibility.

Evaluating Municipal Income Sustainability

Because municipal strategies are interest-based, sustainability analysis focuses on different diagnostics than equity income.

Common evaluation considerations include:

- Duration and yield curve exposure

- Leverage level and borrowing structure

- Credit mix and revenue concentration

- NAV stability through rate cycles

- Distribution coverage relative to net interest income

A stable distribution in a falling-rate environment does not imply resilience in a rising-rate one. Context matters.

Where Municipal Strategies Add Portfolio Value

Municipal income can be a powerful tool when tax efficiency is a primary objective and when investors understand the embedded rate exposure.

These strategies tend to add value when:

- After-tax income matters more than nominal yield

- Portfolio construction benefits from lower correlation to corporate earnings

- Duration risk is intentional and sized appropriately

Compared with REITs or BDCs, municipal income trades operating or credit risk for interest-rate sensitivity. That tradeoff can be attractive, but it is not invisible.

Municipal Income in an Advanced Income Vehicle

Municipal strategies are often described as conservative, but that label oversimplifies reality.

They are best understood as precision tools. In the right circumstances, they improve after-tax income efficiency. In the wrong circumstances, they introduce volatility that surprises investors who expected stability.

Like all advanced income vehicles, their effectiveness depends less on the asset class and more on how deliberately they are used. Municipal income highlights how tax structure can transform otherwise ordinary cash flows.

Other strategies approach the income problem differently:

- REITs rely on operating assets.

- BDCs rely on private credit.

- Closed-end funds rely on pricing dynamics and leverage.

- Option strategies rely on volatility itself.

Each solves a different constraint and exploits a specific opportunity.