Options-Based Income: Monetizing Volatility

Option-based income strategies generate income by selling uncertainty.

Option-based income strategies are often described as “dividend alternatives,” but that framing hides their true economic purpose. These strategies do not generate income from operating businesses or from lending capital. They generate income by selling uncertainty.

Understanding covered call and option-income strategies requires shifting perspective. The income is not a reward for ownership. It is compensation for giving up future upside in exchange for immediate cash flow.

That tradeoff can be useful, but only when it is understood clearly.

Where Option Income Actually Comes From

When an investor sells a call option, they receive a premium. That premium reflects the market’s assessment of future volatility, time to expiration, and the probability that prices move favorably for the buyer.

In covered call strategies, the seller already owns the underlying asset. The premium received is real cash flow, but it is not free.

It represents:

- A transfer of upside potential to the option buyer

- Compensation for assuming obligation under specific market conditions

Unlike dividends or interest, option premiums are not tied to economic productivity. They are tied to market behavior.

Income Smoothing Comes With a Cost

One of the appeals of option-based income strategies is distribution consistency. Premiums can be harvested repeatedly, often monthly, creating a smoother income profile than equity dividends alone.

The tradeoff appears over time.

When markets rise sharply, covered call strategies lag because gains beyond the strike price are surrendered. When markets fall, option premiums provide partial cushioning, but only to the extent that volatility pricing offsets price declines.

This asymmetry is designed on purpose. It is not a failure of execution. The investor trades upside for cash. The cash cushions the downside, for a while.

TROUBLE can happen when the promised returns on that strategy are not sustainable.

An Illustrative Structural Example

Broad-based covered call strategies tied to major equity indexes provide a useful illustration. A vehicle that systematically sells calls on a diversified equity portfolio will typically deliver lower volatility and steady income, while also showing muted long-term price appreciation compared with owning the index outright.

This behavior is visible in strategies benchmarked against long-running buy-write indexes maintained by exchanges such as the Cboe Global Markets. The lesson is not about any one product. It is about the mathematics of option selling.

Income replaces upside. It does not add to it.

Why Yield Can Be Misleading

Option-income strategies often display high headline yields. Those yields can be tempting, especially when compared to traditional dividend-paying equities.

What matters is not the size of the distribution, but its economic source.

Option premiums may be classified as ordinary income, capital gains, or return of capital depending on structure and timing. Return of capital, in this context, is not inherently destructive, but it does reflect that distributions may exceed realized gains in certain periods.

NAV behavior over full market cycles is the most reliable indicator of whether income is being earned or simply advanced.

Volatility Is the Fuel

Option income depends on volatility. When volatility is elevated, premiums increase. When volatility compresses, income potential declines.

This creates a counterintuitive reality. Option-based income often looks most attractive after periods of market stress, when volatility is high, and least attractive during calm, rising markets.

Investors who enter these strategies solely for yield may find that the income they expect is dependent on circumstances that may not be in place for long.

Tax Treatment and Reporting

Most option-income funds and strategies issue a Form 1099, not a K-1. The tax character of distributions varies based on realized gains, option expirations, and fund structure.

Operationally, this simplicity is appealing. Economically, tax outcomes can fluctuate year to year, reinforcing the need to evaluate total return alongside income.

Where Option-Based Income Fits Best

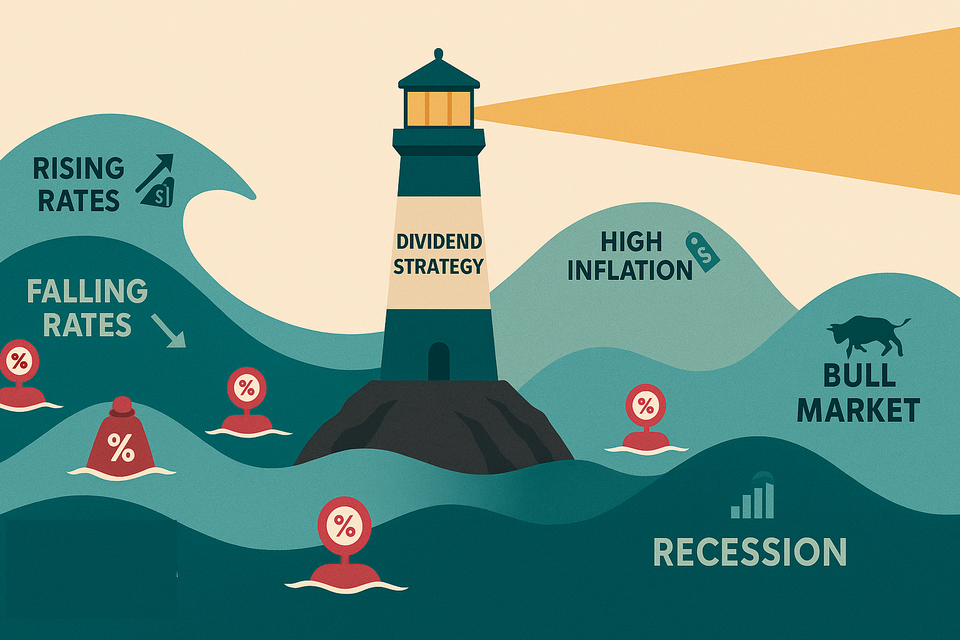

Option strategies are best understood as tools for reshaping return profiles rather than maximizing returns.

They tend to add value when:

- Income consistency is prioritized over capital appreciation

- Markets are range-bound or volatile rather than strongly trending

- Portfolio construction benefits from reduced drawdowns

They are less effective when long-term growth is the primary objective or when markets experience sustained directional moves.

Compared with REITs, BDCs, or municipal strategies, option-income vehicles do not rely on assets, credit, or tax structure. They rely on market psychology.

Option Income as Part of an Advanced Toolkit

Option-based income is neither conservative nor aggressive by default. It is precise.

Used intentionally, it converts uncertainty into cash flow. Used indiscriminately, it can quietly trade away future returns without the investor realizing it until much later.

The distinction lies not in the strategy itself, but in whether the investor understands what they are selling.